What’s the outlook for the Australian property markets for the rest of 2021 and beyond?

This is a common question people are asking now that our real estate markets are experiencing the challenges of lockdowns.

However, despite a sequence of fifteen State or Territory lockdowns so far this year, property prices have been largely unscathed.

And even though the rate of house price growth is slowing, property values keep rising in almost every market around the country and our capital cities are in line for strong double digit property price growth this year.

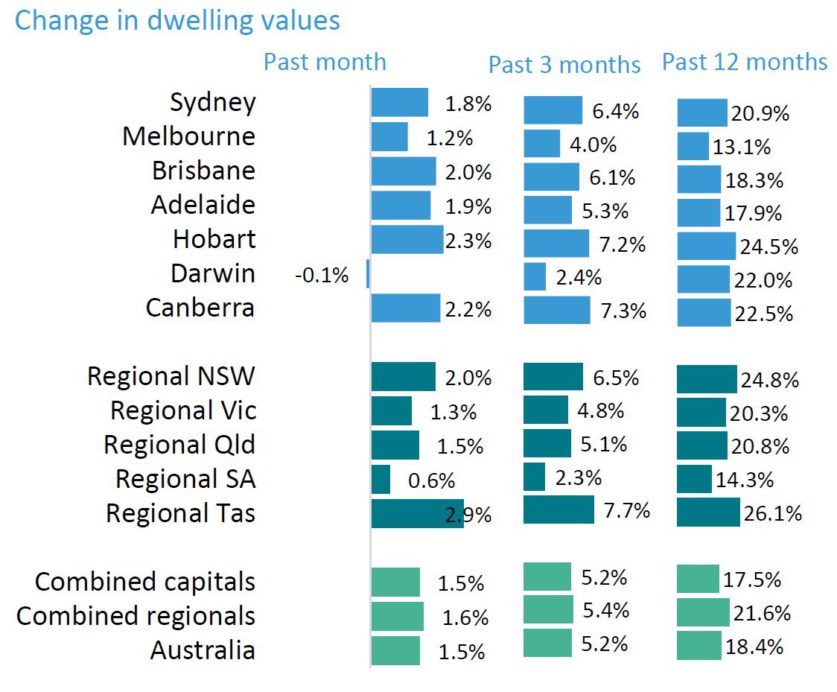

Over the past year, Sydney house prices have risen almost 20%, Melbourne 11.8% and Brisbane 18.6%.

But the momentum in growth is showing signs of easing, since peaking in March.

At the same time vendors are now holding back putting their properties on the market for sale due to the uncertainty of the effects of our lockdowns.

But while our Covid cocoons are slowing down our markets, the eventual easing in restrictions should see activity rebound swiftly and price growth lifts again into year-end.

Recently ANZ has updated its property price forecasts in response to the market’s resilience in the face of extended lockdowns.

It joins Australia’s other major banks in predicting house prices will jump 20% by the end of the year as a stronger than expected property market rides out extended lockdowns across Victoria and NSW.

These higher forecasts are reflective of the market’s adjustment to lockdowns this time around, as buyers have overcome concerns around remote auctions and expats have increasingly joined investors adding to property demand.

The new figure is higher than earlier forecasted gains of between 15% and 20%, with the bank also projecting price growth would slow to 7% growth in 2022.

What a turnaround from all the pessimistic forecasts all the banks made in the middle of last year.

ANZ joins Australia’s big four banks in revising its forecasts upwards amid lockdowns, with its updated projections similar to those put out by the Commonwealth Bank earlier this month.

NAB in July suggested house prices would jump 18.5% in 2021 and 3.6% next year across capital cities, while Westpac forecast a jump of 18% this year and 5% next.

Here’s what’s been happening to Australian house prices over the last year…

What’s ahead for our property markets?

LET’S HAVE A LOOK AT 6 PROPERTY TRENDS THAT I THINK WILL OCCUR IN 2021.

- Property demand from home buyers is going to continue to be strong

Currently, home prices are surging around Australia, auction clearance rates remain high, and the media keeps reminding us we’re in a property boom.

The result is emotions are running high at the moment, with FOMO (fear of missing out) being a common theme around Australia’s property markets.

One of the leading indicators I watch carefully is finance housing approvals, and these are suggesting that more Aussies are looking at getting into property and we will have strong ongoing demand from owner-occupiers and investors over the next 6 months.

Now, with borrowing costs lower than they ever have been, the reassurance that interest rates won’t rise for a number of years, it is likely that buyer demand will remain strong throughout the year.

In fact, this is a self-fulfilling prophecy…

As property values increase and the media reports more positively about our property markets, FOMO will mean more buyers will be keen to get in the market before it prices them out.

2. Investors will squeeze out first home buyers

While there were many first-time buyers (FHB’s) in the market in the first half of the year, buoyed by the many incentives being offered to them, now demand from FHB’s is fading and property investors re-enter the market and property values rise.

Of course over the last few years investor lending has been low, but with historically low-interest rates and easing lending restrictions, investors are back with a vengeance.

3. Property Prices will continue to rise

While many factors affect property values, the main drivers of property price growth are consumer confidence, low-interest rates, economic growth and a favourable supply and demand ratio.

As always, there are multiple real estate markets around Australia, but in general property values should increase strongly throughout 2021.

However certain segments of the market will still continue to suffer, in particular in the city apartment towers and accommodation around universities.

It is unlikely these segments of the market will pick up for some time and the value of these apartments is likely to continue to fall as there just won’t be buyers for secondary properties.

At the same time, some rental market will remain challenging. In particular, the inner-city apartment markets are reliant on students, tourists (AirBNB) and overseas arrivals.

But overall, Australia’s low mortgage rates continue to underpin very strong growth in property prices throughout the country.

Read more on the propertyupdate!